CMG Insights

August US ECM Activity: Signaling a Rebound or Pump Fake?

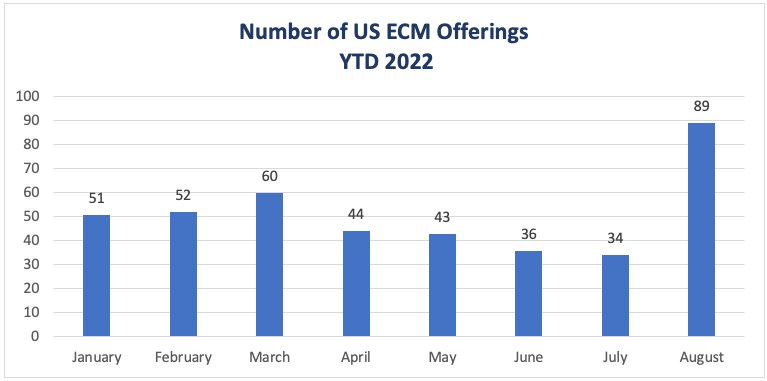

August is historically a slow month for the US ECM market but that wasn’t the case this year. CMG data shows that August ECM dollar volume amounted to $12.9B, making it the second most active month of the year, behind only January’s $13.98B. August had the highest number of completed deals this year with 89 deals priced in the month (excluding SPACs), which was nearly 50% greater than the next best month (March). This also compares very favorably to last August’s total of 85 priced deals that occurred during an extremely robust ECM environment.

Healthcare was a standout sector last month with 40 priced offerings that constituted 45% of the total deal volume across sectors. CMG data shows that this trend is above the average number of deals for the sector considering that ~31% of all priced offerings (year to date) were Healthcare deals.

In terms of dollar volume, the largest deals that priced in August were TC Energy (TRP) with a $1.4B registered block, Charles Schwab (SCHW) with a $895M unregistered block and Karuna Technologies with an $863M marketed follow-on. These three offerings constituted ~24% of all dollar volume for the entire month.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.

Questions?

We want to hear from you.