CMG Insights

Has the IPO Market Bounced off the Bottom?

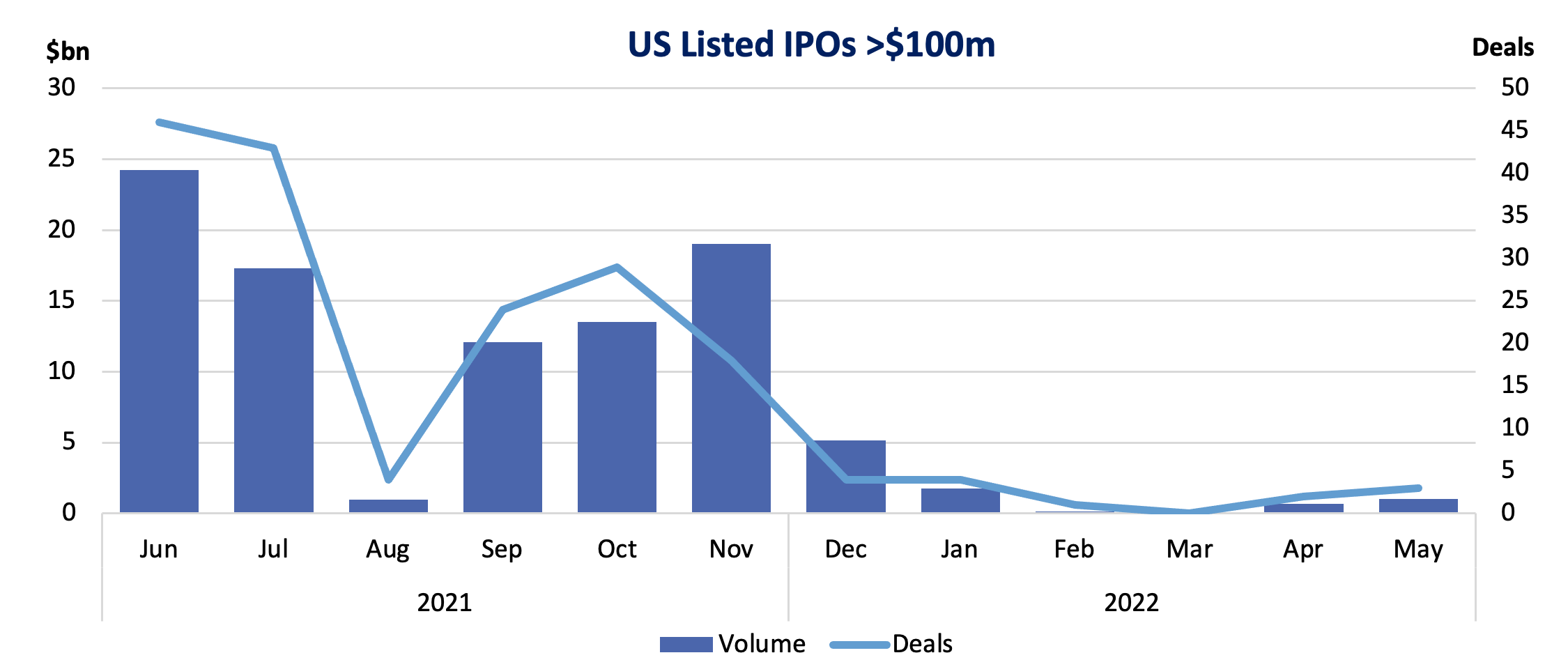

While ECM volume continues to trend down compared to previous years, the month of May saw a slight uptick of IPO dollar volume over previous months. Of the 11 deals that priced during the month, three of them were above $100m which is the most in a single month since January and could be a potential signal that issuers will start to make their way back to the IPO market. CMG performance data shows +$100m deals priced this year trading on average at (4.4%) offer-to-current; while smaller IPOs (below $100m) are trading at (28.1%) offer-to-current.

Bausch & Lomb Corp. priced the largest IPO of the month, a $630m deal on May 5th. The deal was also notable as it was the first 100% secondary IPO to price since Hertz Global Holdings priced a $1.3m IPO on November 8th, 2021.

CMG data pulled from CMG DataLab shows that there were no IPOs priced above range in the month of May, marking the third consecutive month that an IPO did not exceed range. The last IPO to price above its range was on February 10th when SQL Technologies priced a $23m deal; however, that offering has reversed course as reflected by a recent (74.4%) price return below offer price.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.

Questions?

We want to hear from you.