CMG Insights

Is IPO activity heating up?

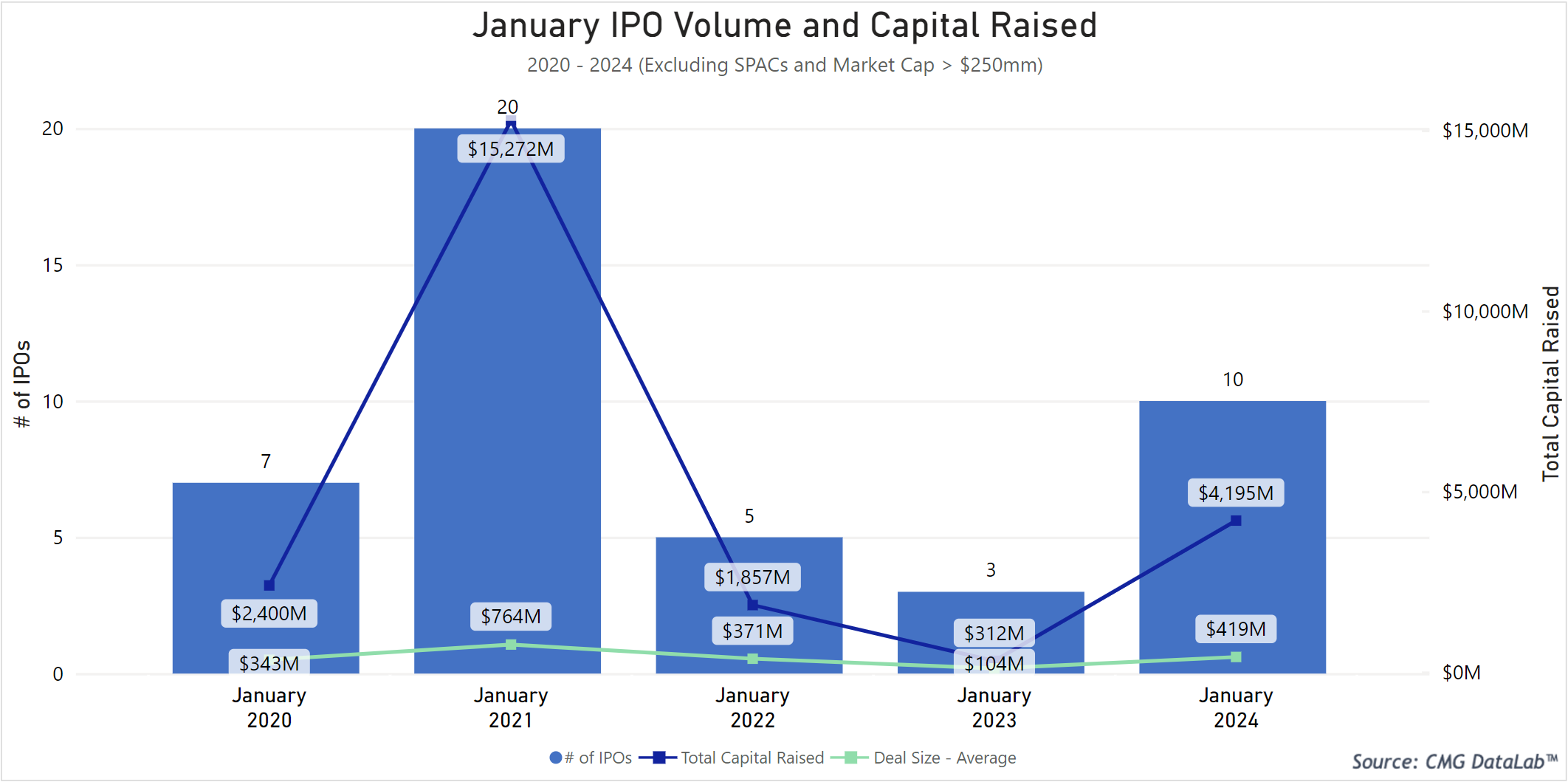

U.S. ECM activity in January totaled $14.4 billion via 50 offerings. U.S. IPO activity surged with 10 offerings amassing $4.2 billion of the total issuance, a 1,246% increase in IPO volume compared to January 2023, and an 84% increase compared to total Q1 2023 activity. On average, U.S. IPOs traded up 8% on Day 1, while Healthcare IPOs outperformed all other sectors, trading up 30% on Day 1. CG Oncology Inc. led the charge on performance, up 96% on Day 1.

On the last day of January, Amer Sports priced the largest IPO YTD raising $1.3 billion, the biggest in the U.S. since Birkenstock Holding Limited in October 2023, according to CMG data. With the pricing of Amer Sports and Kaspi.kz, January marks the first month with two IPOs raising over $1 billion since December 2021, foreshadowing a possible rebound in the IPO market.

Check out our 2023 U.S. ECM Recap for other notable IPOs on file, some which may file in 2024, plus metrics from last year’s performance.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.

Questions?

We want to hear from you.