Global ECM activity in June and July raised $49.4bn via 318 transactions tracked by CMG, a 15.4% increase from the $42.8bn raised via 146 transactions in June and July of last year (ex. Rights offerings). CMG data points to North America as the most active global region in deal volume with $25.1bn raised via 139 transactions. GE HealthCare Technologies (GEHC) led the way with a robust $2.2bn marketed follow-on offering on June 7th.

Savers Value Village, Inc. (SVV) was the largest U.S. IPO in June and July at $461.4M – posting an impressive 37.6% offer-to-open according to CMG data. However, Cava Group (CAVA) recorded the largest offer-to-open pop of 91%. This $365.4M offering was led by J.P. Morgan.

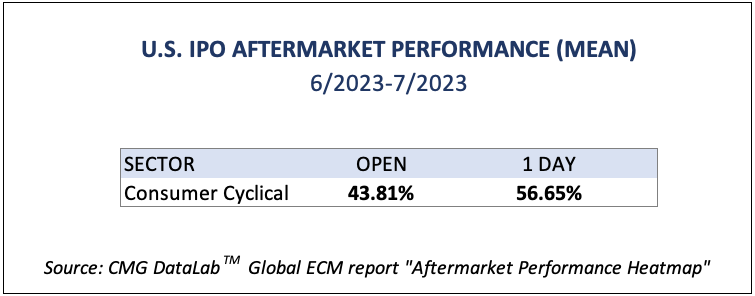

Interestingly, there were four consumer cyclical U.S. IPOs over the summer (CTNT, SVV, GENK, CAVA) and all four performed markedly well into the close of their first trading day. Two of the four (SVV, CAVA) priced above their initial IPO range, signaling that Wall St. may be comfortable betting on consumer resiliency. The below graphic highlights the average performance of those four U.S. consumer IPOs.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.