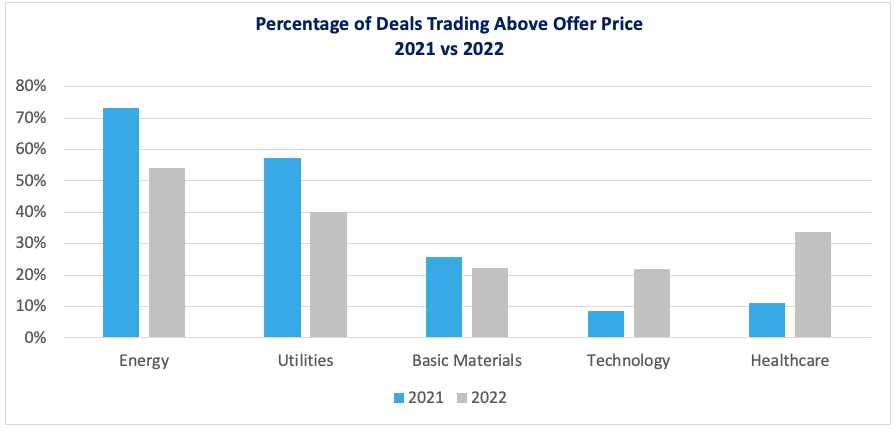

As sectors go in and out of favor, it’s interesting to note how ECM pricing reflects market sentiment. One way to look at sector performance is by analyzing the current percentage of deals trading above their offer price.

Consistent with 2021, Energy remains a standout sector year to date according to CMG data. Looking at Energy offerings that priced through September of ’21, there are 73.1% still trading above their offer price. This year, there are a respectable 54.2% of deals trading above the offer price. With recent market volatility it’s not surprising that the Utility sector has demonstrated resiliency with 57.1% of last year’s offerings trading above offer price and 40.0% of this year’s deals trading above offer.

CMG data shows Healthcare as the sector with the most year-over-year positive divergence. We see that only 11% of offerings that priced through September of ‘21 are currently trading above their offer price, while nearly 34% of this year’s offerings remain above offer price. Healthcare stock was in high demand in 2021 and it’s clear that pricing was at premium. This year the data may indicate less demand for Healthcare names, resulting in more balanced offering levels.

While reviewing a thinner ECM calendar, market participants may want to look at sector performance for market insights.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.