TL;DR

- Global equity issuance rebounded in January, with the U.S., EMEA and APAC all posting year-over-year growth in capital raised.

- U.S. activity accelerated, driven by follow-on offerings and the strongest month for SPAC issuance since 2021.

- Industrials led sector issuance, topping capital raised in both the U.S. and EMEA and delivering strong dollar-weighted aftermarket performance.

- APAC dominated by deal count, while EMEA issuance was supported by large-cap transactions and improving investor risk appetite.

U.S. Equity Issuance Activity Accelerates

U.S. equity issuance showed a notable pickup in January, with 40 offerings raising $14.0B, representing a 43% increase year-over-year. The rebound in capital raised suggests improving issuer confidence and growing investor appetite, particularly for the 33 follow-on offerings, which accounted for a significant share of activity.

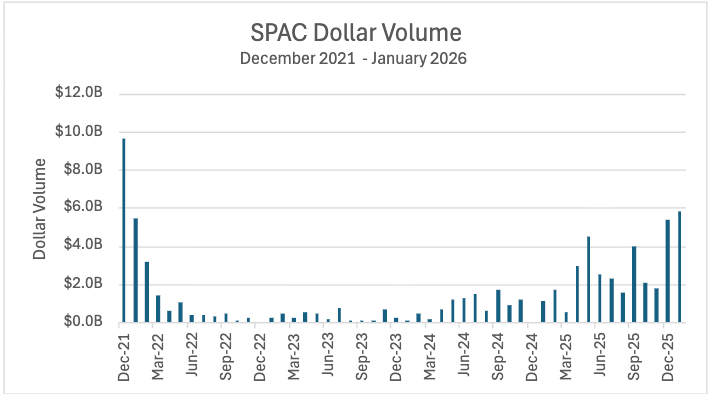

Hottest Month for U.S. SPACs Since 2021

SPAC issuance posted $5.8B in capital, the strongest month in years, marking the most active period since December 2021 with $9.6B. While overall volumes remain well below peak-cycle levels, the sharp inflection signals a thawing in a segment that has been largely dormant.

Industrials Take the Lead

After several months of healthcare-led issuance ($4.5B raised in the U.S. and no activity in EMEA), Industrials emerged as a standout sector, leading capital raised with $5.1B in the U.S. and $5.6B in EMEA.

Performance has been strong, with EMEA Industrials delivering a +26.5% dollar-weighted average return on day 1, while U.S. Industrials posted +6.0%. This strength mirrors the outperformance explored in Markets Cool in October. Dutch industrials company CSG B.V.’s (CSG) $4.5B IPO included an overallotment that was fully exercised and delivered a 31.4% first-day gain, underscoring strong investor demand for high-quality industrial issuers.

EMEA and APAC Drive the Story

Outside the U.S., issuance activity was led by EMEA and APAC, both posting meaningful year-over-year growth in capital raised. EMEA issuance totaled $7.2B across 11 offerings, driven by large-cap Industrials and financials amid improving macro conditions. APAC raised $11.2B across 44 offerings, leading globally by deal count.

January’s issuance data points to a broadening recovery in global ECM activity, marked by increased U.S. follow-ons, a SPAC revival, sector rotation toward Industrials and strengthening pipelines in EMEA and APAC. If trends continue, Industrials may remain a focal point for issuance and aftermarket outperformance in the months ahead.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.