With a total of $12.0B in capital raised, the month of June saw an uptick in ECM market activity surpassing both April ($7.6B) and May’s ($6.3B) totals. Marketed follow-ons represented 30.2% of total ECM issuance in H1 ($17.0B), and 75.0% of total ECM issuance in the month of June ($9.0B).

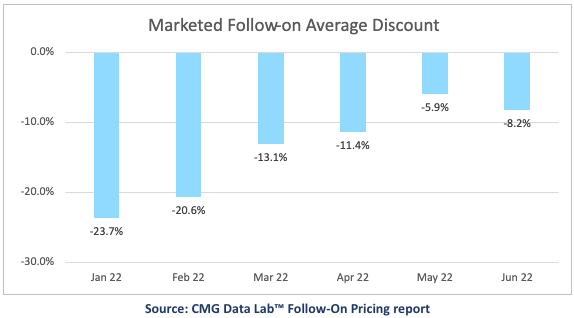

Of note, marketed follow-on discounts have steadily declined from January of this year. Discounts in January were -23.7% and have come down to -5.9% in May and -8.2% in June.

Going back to 2006, marketed follow-ons have had an average discount of -11.0%. Interesting that in January and February those discounts were much steeper than the historical average while today’s discounts are well under that historical average. This could signal a renewed appetite for ECM offerings at today’s stock prices. Brazilian Electric Power Co. priced the largest marketed follow-on of the month, a $5.9B deal on June 9, with a -7.0% file to offer discount.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.