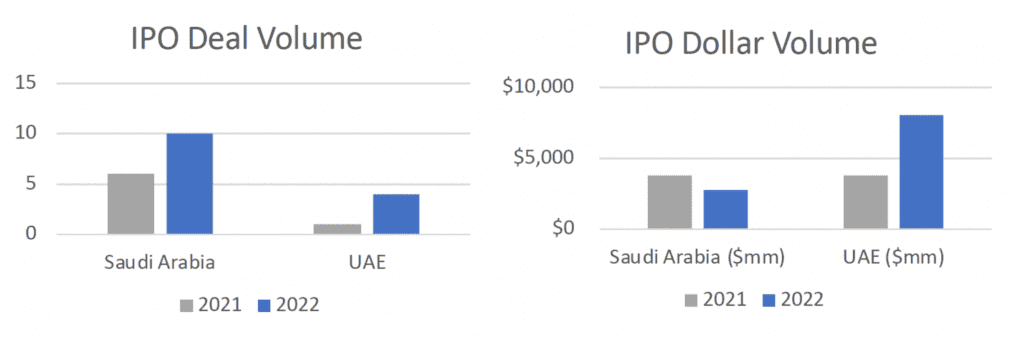

November put a spotlight on the Middle East with the start of the World Cup, but ECM trends show that the regional IPO market is also grabbing headlines. When comparing IPO volumes year-over-year using CMG’s International data, Saudi Arabia posted a 67% increase in priced IPOs. In fact, much of the equity activity has been timed in lock-step with the World Cup with 50% of the IPO volume occurring since November.

Taking a closer look and focusing on CMG’s filed/pending offerings, it appears this trend has legs as there are three pending Saudi IPOs, lead by Saudi Aramco’s Luberof $1.3bn IPO.

Volume is not the only indicator of growing ECM interest within the Middle East. CMG data suggests dollar volume for UAE’s IPO market increased from $1.89bn to $8.03bn, which equates to a 325% increase of total capital raised year-over-year. Dubai Electricity & Water’s $6.8bn IPO represents the largest offering from the UAE to price in 2022.

The sheer increase in both volume and dollar volume of IPOs, highlights that the Middle East has been a unique bright spot in an otherwise challenging year for the IPO market.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.