U.S. ECM issuance in May totaled $22.6B via 66 offerings, an 82.3% increase in dollar volume compared to April. $12.3B of capital was raised via 33 blocks. May marked the highest monthly dollar volume attributed to blocks since November 2021. Corebridge Financial, Inc., Applovin Corp, Permian Resources Corporation, and Digital Realty Trust Inc. each raised over $850M via block trades.

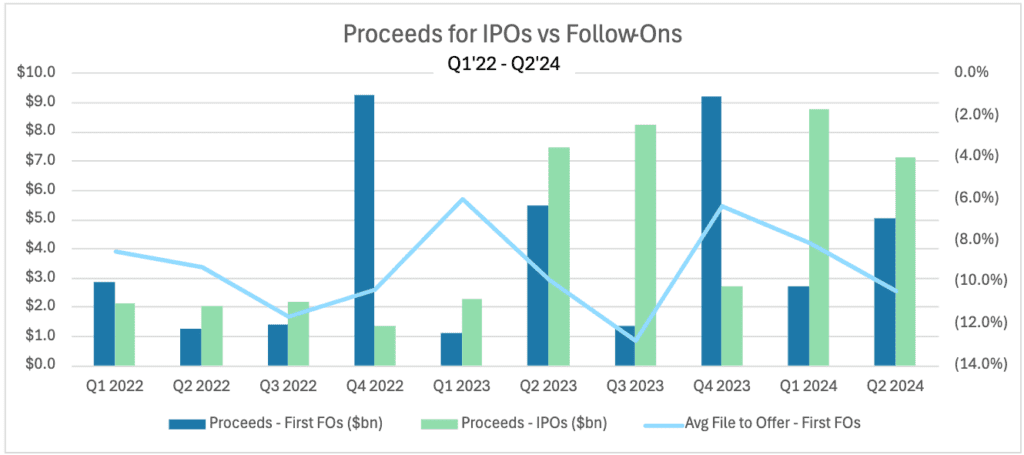

May also witnessed notably high first follow-on volume, totaling $5.0B via 6 offerings and a monthly dollar volume watermark not seen since 2021. Back-to-market offerings had a file-to-offer discount of -10.4% and traded up 1.2% on the open on average.

Kenvue Inc. raised $3.6B in its first follow-on, the largest first follow-on offering since 2015. The offering was comprised of entirely secondary shares, as the former majority owner, Johnson & Johnson, exits the company a year after its initial launch.

In 2013, Meta Platforms, Inc., formerly Facebook, launched its first follow-on of $3.8B 19 months following its IPO. There have been only 4 first follow-on offerings greater than $3B since 2013 (including Meta).

Aftermarket performance lagged in May compared to previous months, but the Consumer Cyclical sector outperformed the field, up 12.5% on average on the open. Dollar-weighted performance of the 6 IPOs in May was 17.6% on the open and 23.8% on Day 3. With 5 IPOs expected to price in the first week of June, there is evidence activity may be accelerating in the coming months.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.