In July, U.S. ECM issuance surged to $13.7B across 27 offerings, marking an 86% year-over-year increase in dollar volume. Notably, $7.2B was raised through 8 IPOs, a staggering 607% increase from last year. Additionally, 4 SPAC IPO offerings raised $1B, pushing 2024’s YTD volume past 2023’s total of $1.4B.

For the first time since September 2021, two offerings each exceeded $2.7B. In 2023, only two offerings surpassed this size. The average IPO offering size grew by 77% from July 2023 to July 2024. Among the 8 IPOs, July also witnessed $1B in capital via 4 SPACs, the highest monthly volume in over two years.

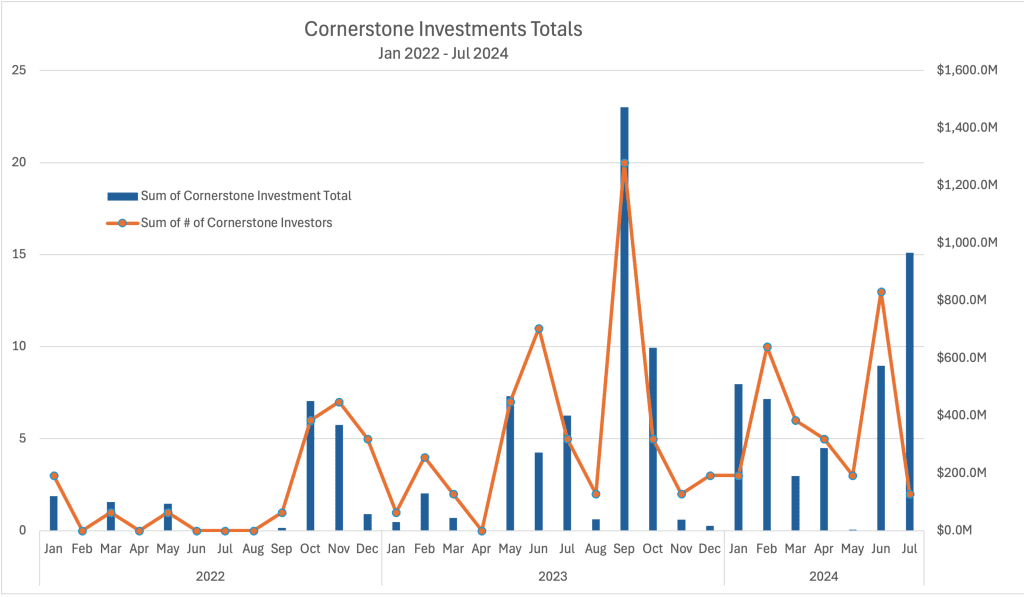

Lineage, Inc.’s IPO alone raised $4.4B, accounting for 61% of the total IPO proceeds. This included $900M from cornerstone investors, the largest such total year-to-date (based on CMG data). Cornerstone investors were significant in both the Lineage, Inc. and OneStream, Inc. IPOs, contributing nearly $1B in total, with $900M from Norges’ investment in Lineage, Inc.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.