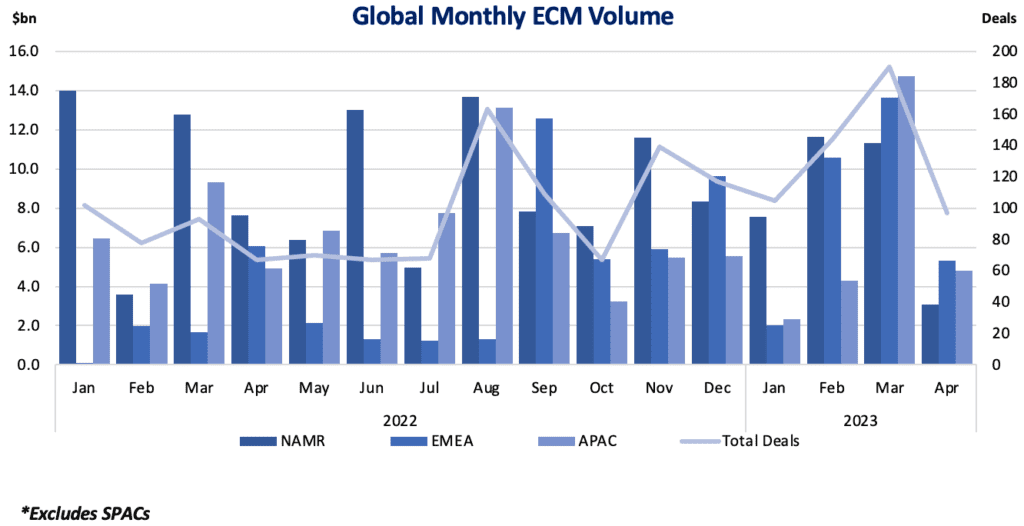

Global ECM activity in April raised $13.8bn via 100 transactions, a 65% decrease from the $39.7bn raised via 190 transactions in March. EMEA led the global regions in deal volume with $5.3bn raised via 25 transactions, with the largest deal of the month in the region being TUI AG’s $2bn marketed follow-on offering on April 17. The deal was the largest German offering since Porsche AG priced their $7.8bn IPO on September 28, 2022.

US listed ECM slumped to $3bn raised (a 72% month-over-month decrease) via 38 transactions amidst wider concerns over bank closures. The $3bn raised represented the lowest monthly US listed volume since August 2011 when $2.8bn was raised via 11 transactions. The IPO market added to the slow down as only one deal <$25m priced (Millennium Group International Holdings)*.

As the year progresses, there is reason for optimism, the IPO market could be poised for growth based on recent filings data. Kenvue Inc filed for a $3.25bn IPO in January, which was the largest US listed IPO since November 9, 2021 when Rivian Automotive priced their $13.7bn IPO. This month we’re seeing volume make a comeback with 15 IPOs getting filed.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.