U.S. ECM activity in January totaled $8.4B via 28 offerings. Nine IPOs raised $3.9B, on average trading up 12.5% on Day 1 with 67% pricing in or above range. Metsera, Beta Bionics, and Flowco Holdings led the charge for performance, surging 47.2%, 39.0%, and 23.8% on Day 1, respectively. Nineteen follow-on offerings raised $4.5B, averaging an -8.4% file-to-offer discount, the steepest monthly discount since July 2022 (-11.6%). Energy offerings totaled 57% of dollar volume, the highest share for the sector since February 2021.

Despite a slow start to the year in the U.S., EMEA markets recorded the busiest January since 2019, with $7.2B across 13 offerings. Haleon and British American Tobacco both priced follow-on offerings on the London Stock Exchange raising $3.0B and $1.5B in proceeds, respectively.

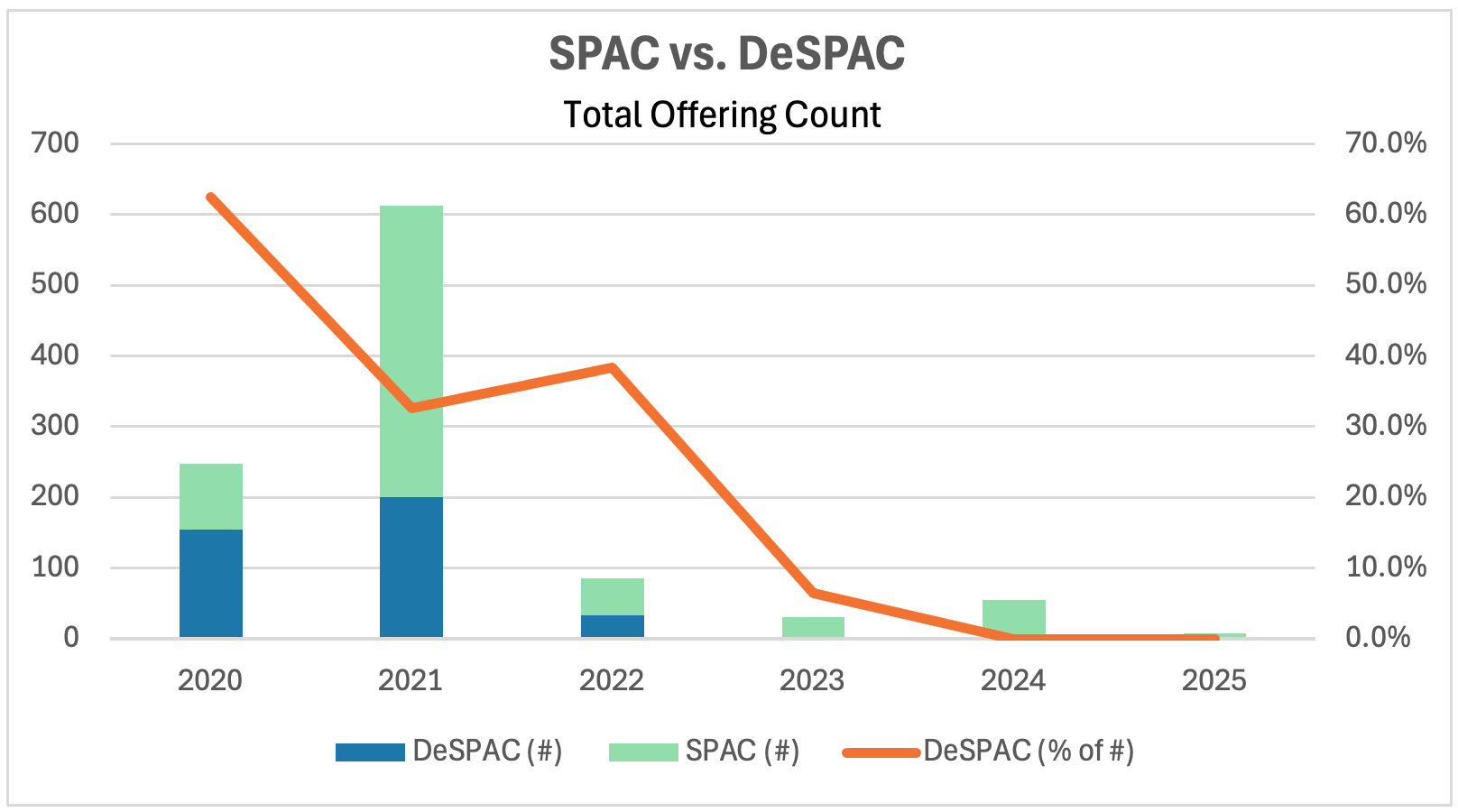

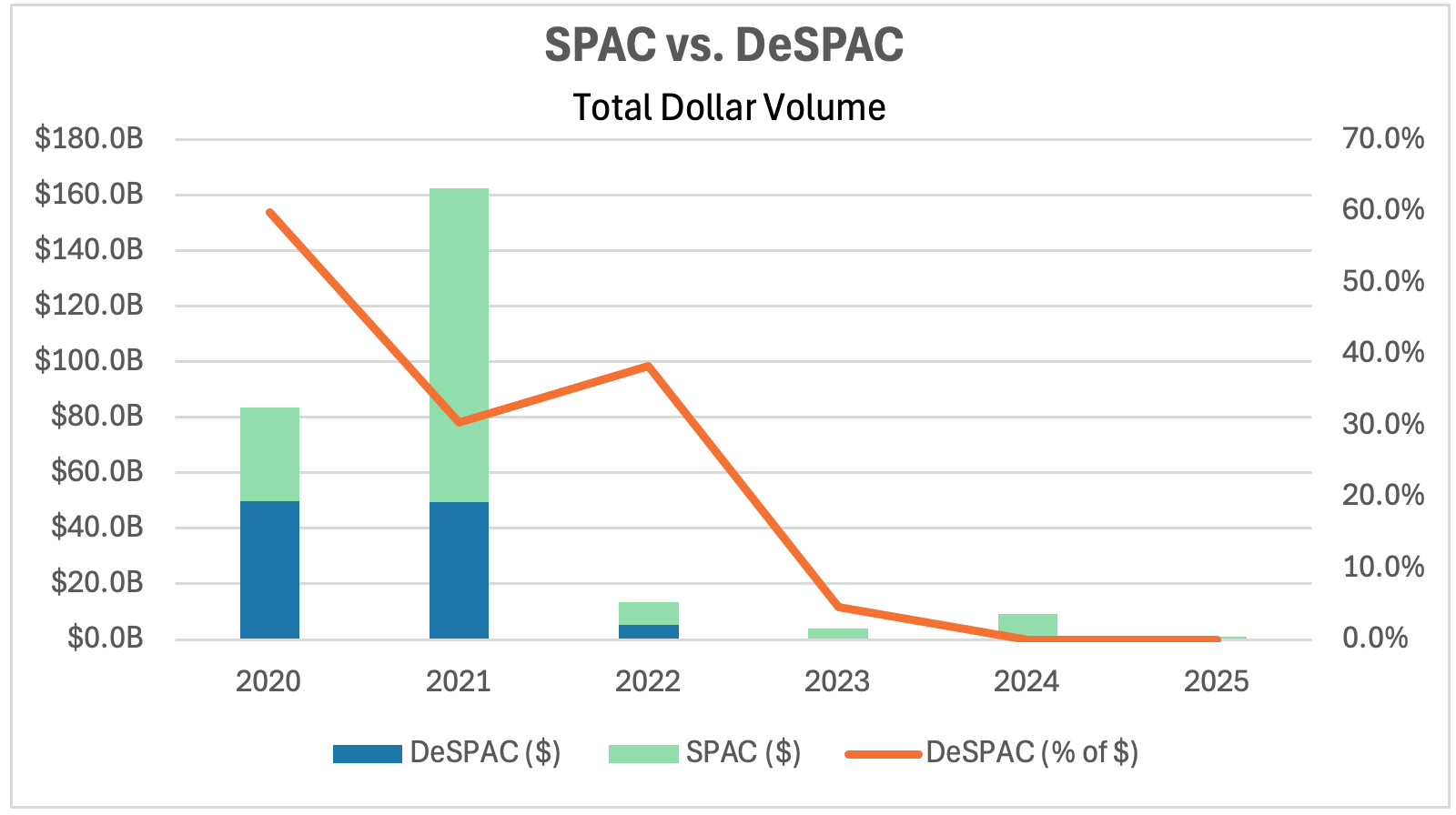

Eight SPAC IPOs raised $1.1B, marking the sixth $1B+ month in the last eight months for U.S. SPACs. Notably, six of January’s 19 follow-ons were companies that had previously gone public via a SPAC. Since 2020, 1,041 SPAC IPOs have raised $273.6B in capital. Three hundred and ninety of them have since completed a de-SPAC transition. The residual being 651 SPACs with $169.0B in capital to deploy or return to investors. Over the same period, 25.1% of de-SPAC companies acquired targets in the Technology sector. Healthcare was the second most targeted sector, accounting for 21.8% of acquisitions. Additional SPAC activity can contribute to accelerating momentum in the broader M&A market.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.