TL;DR

- Strong July issuance – 43 deals raised $19.6B, making it the second-highest July on record, trailing only 2021.

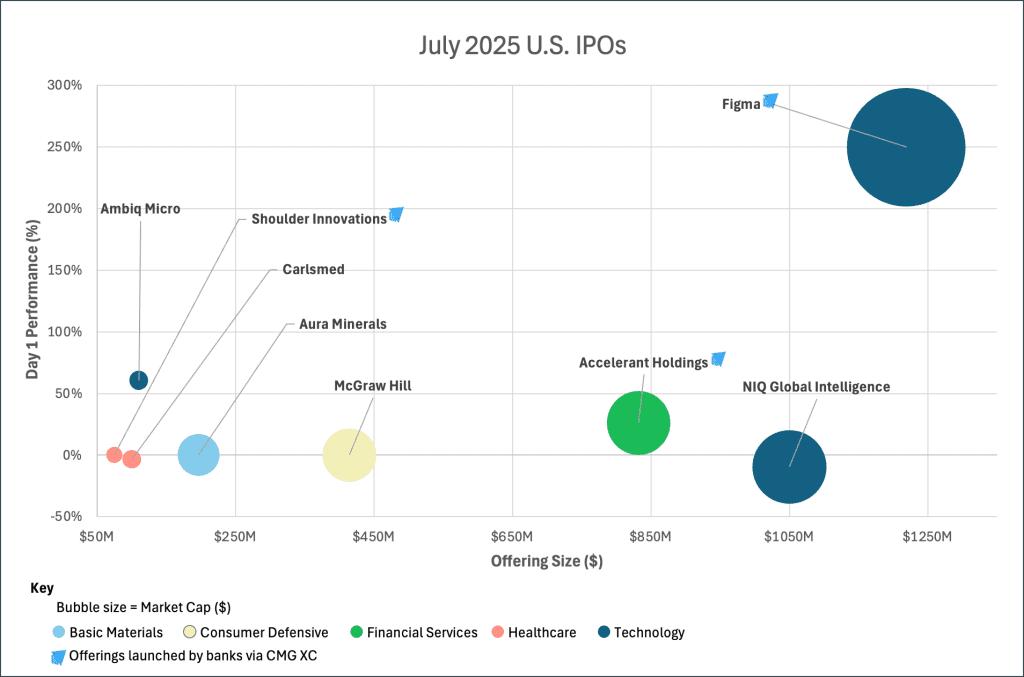

- IPO momentum – 8 IPOs raised $4.0B with a stellar 80.8% average Day 1 return. Figma set a record as the best-performing $50M+ IPO in U.S. history.

- Micro-IPO surge – 17 micro-IPOs lifted the YTD total to 88; July was the fourth month with 14+ micro deals—a first for any calendar year.

- SPAC revival – 11 SPACs raised $2.3B, pushing YTD totals to 77 deals and $13.3B—up 40% in volume and 67.8% in proceeds vs. 2024.

- Large-cap issuance trend – 14 issuers raised $500M+, continuing a 2025 streak of mega-deals not seen since 2021.

Strong July Issuance

Momentum in the equity markets continued into July, building on the strong rebound seen in May and June. While July didn’t reach the record-setting $30B levels seen in months prior, it still posted a robust showing: 43 deals raised $19.6B, making it the second-highest July in recent history, behind July 2021.

IPO Momentum

IPOs continued their resurgence with 8 IPOs raising a total $4.0B in issuance, trading up 80.8% on a dollar-weighted basis Day 1. Figma captured headlines for its record-breaking debut – the highest performing IPO greater than $50M in U.S. history. Figma and NIQ Global Intelligence each raised over $1B, pushing the YTD total to 6 such mega-IPOs. Notably, every month of 2025 has seen at least one IPO exceed $600M, highlighting a streak of large-cap IPO activity not seen since 2021.

Micro-IPO Surge

July also marked a sharp rebound for U.S. micro-IPOs with 17 offerings raising less than $50M in proceeds. This lifted the 2025 total to 88, with 89.7% listing on the Nasdaq and 82.9% headquartered outside the U.S. July was the fourth month this year with 14 or more micro-IPOs, a frequency unseen in a calendar year. For a deeper dive into this trend, check out our Insights: The Recent Surge in Microcap IPOs – CMG

SPAC Revival

SPACs continued their revival as well. In July, 11 SPACs raised $2.3B, bringing the year-to-date total to 77 – a 40% increase in volume and a 67.8% rise in capital raised compared to last year’s total. It was also the fourth consecutive month with double-digit SPAC counts and over $2.2B in issuance.

Follow-On Market Stays Active

Despite the competing focus of earnings season, the follow-on market persisted. 35 offerings raised $15.6B with the average file-to-offer discount rising to 8.3%, up from 4.8% in May and 6.6% in June. With the exception of marketed follow-ons, which dropped in discount from 3.93% to 3.56%, other offering types saw increases in pricing discounts month over month.

Blocks trades, although down in volume from Q2’s record highs, saw a notable rise in quality. The average deal size climbed to $721.3M, compared to $567.8M in May and $532.2M in June. July also stood out as the only month of the three to post a positive average Day 1 performance.

Large-Cap Issuance Trend

A defining theme of 2025 has been the surge in large equity offerings and this narrative continued into July. Fourteen issuers raised over $500M, marking the fourth month this year with 12 or more such deals. To put this in perspective: since 2021, only 3 months have achieved this milestone of 12 or more $500M offerings. Into the second half the year, investors are awaiting big names such as Klarna, Stubhub, and Cerebras Systems to sustain the flow of sizeable offerings.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.