The S&P 500 was up a healthy 6.2% in January of this year. Unfortunately, a strong stock market did not translate to high US ECM volume. According to CMG data, January produced 50 offerings that raised just $7.2B in capital. Furthermore, the IPO market was particularly lackluster. There were seven IPOs that raised only $347M in capital (ex SPACs).

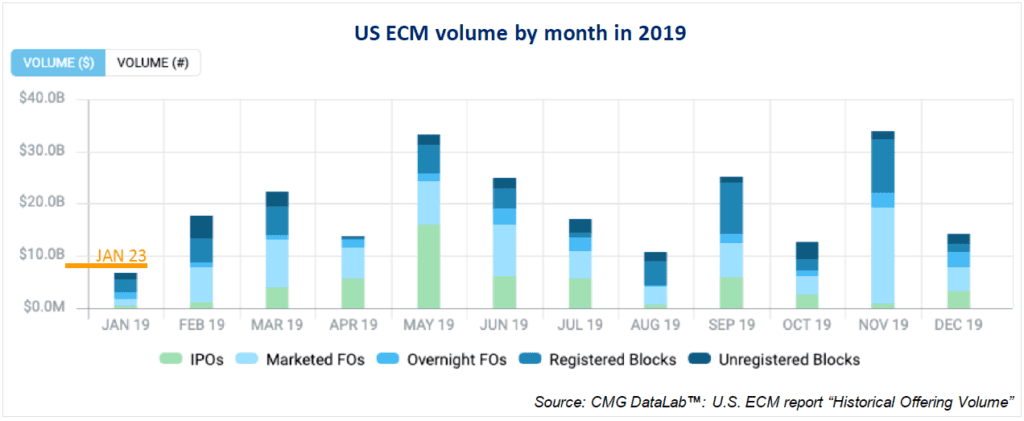

The last time the dichotomy between US stock market performance and ECM volume was this drastic was in 2019. In January of that year the S&P 500 was up 7.9% while US ECM volume came in at 42 offerings raising $6.7B in capital. IPO volume was also strikingly similar with two offerings raising $300M in capital.

Given the similarities, let’s look at what happened next in 2019. From February 1 to December 31, 2019, there were 854 offerings that raised $225.2B in capital. IPOs picked up in March, and the year ended with 164 IPOs raising $50.6B in capital (ex SPACs). During that time, on average, IPOs opened up 14.5%.

After a very sluggish start, 2019 turned out to be a marquee year for large IPOs including: Lyft, Tradeweb, Pinterest, Uber, Avantor, Chewy, SmileDirectClub, Peloton, and XP Inc. Those IPOs on average opened up 15.5% and are, on average, up 10.4% as of February 1, 2023. Will ECM continue to gain momentum into year-end, like we saw in 2019?

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.