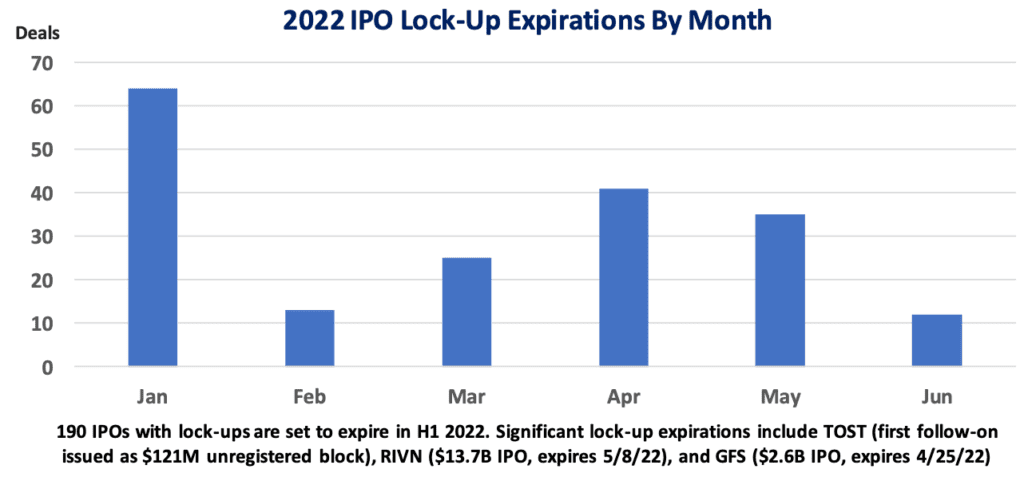

It is no secret that there have been fewer offerings, specifically IPOs, that have come to market thus far in 2022. That doesn’t mean that there isn’t opportunity to be seized in this market. The second half of 2021 saw 202 IPOs launch with over $70 billion in capital raised. The lock-up periods on those deals all have or will be expiring over the first half of 2022.

Beyond significant aftermarket performance impact, the other inherent opportunity that has and will continue to arise from IPO lock-up expirations is first follow-on offerings, including unregistered blocks. In fact, unregistered blocks have made up the largest percentage of first follow-ons YTD (37%).

Only a small percentage of IPOs with lock-ups that have expired this year have issued first follow-ons, indicating that there is likely a backlog waiting for market stabilization. CMG’s front-end and API offer the ability to track, analyze and generate trading strategies around lock-up expirations, follow-ons (including unregistered blocks) and all other aspects of ECM deal flow.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.