TL;DR

Equity issuance slowed in October with 47 offerings raising $14.9B — down 40.8% month-over-month and the lowest volume since April. Follow-ons dominated (78% of total volume) as IPO activity softened under regulatory headwinds.

Healthcare led the way, posting its strongest month of 2025 with 24 deals totaling $5.2B and a +11.4% average 1-day return, highlighted by Palisade Bio’s +86.8% surge. ATM activity in the sector remained elevated but modest in dollar terms.

Technology sentiment reversed, with only three offerings pricing and an average –20.8% 1-day weighted performance, a sharp contrast from Q3’s strength.

Looking ahead to November, several notable lock-ups expire and could set the tone for post-IPO activity and secondary market momentum.

Momentum Derailed: October’s Market Cools

After months of steady issuance, equity capital market activity mellowed in October. Forty-seven offerings raised $14.9 billion, marking a 40.8% decline from September and the lowest since April. Despite regulatory headwinds seen with the government shutdown, six IPOs greater than $50 million successfully priced in October, collectively raising $3.3 billion. Follow-on issuance held firmer footing, with 41 offerings generating $11.6 billion, accounting for 78% of total monthly volume. This underscores the market’s continued reliance on secondary issuance.

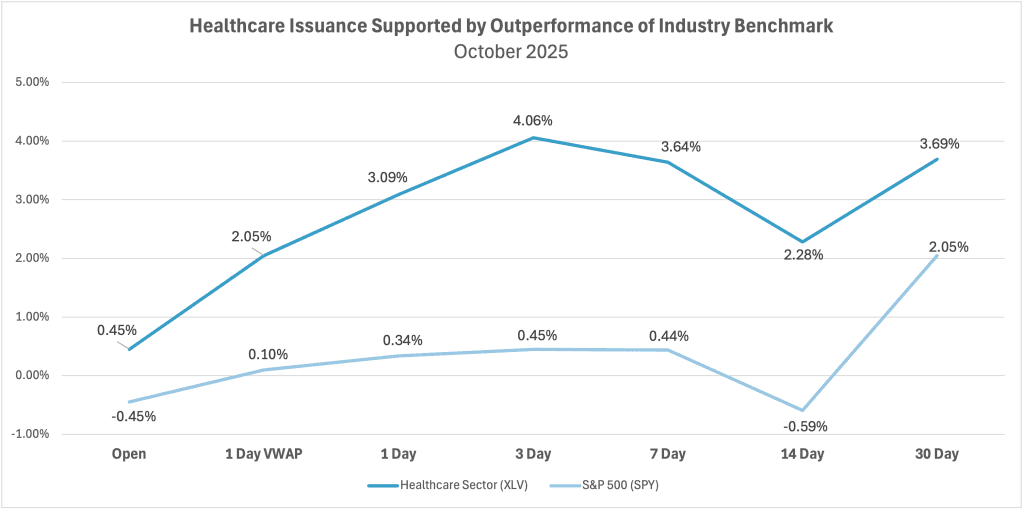

Healthcare Issuance Supported by Outperformance of Industry Benchmark

Healthcare was the most active sector in October. With 24 offerings raising $5.2 billion, the year’s highest count and dollar volume, Healthcare deals averaged an 11.4% one-day weighted return, with an alpha of +9.6% relative to the market (SPY). Palisade Bio’s follow-on stole the spotlight, delivering a remarkable alpha of +86.8% to market, reinforcing the sector’s momentum despite broader market softness.

ATM (at-the-market) activity also accelerated in October. As reported in our Q3 recap, Healthcare was the most active sector with 573 open programs representing just 3.6% of total open program size. This same narrative rings true this month as Healthcare accounted for nearly half of all ATM filings over $50 million, yet contributed just 8.1% of total program size.

Technology Sentiment Shifts

After leading Q3 issuance with $12.3 billion raised and a +39.8% weighted one-day performance, the Technology sector cooled in October. Only three offerings priced above $50 million, raising a combined $3.3 billion, and collectively traded -20.8% on a dollar-weighted one-day basis.

Looking Ahead: Upcoming Lock-up Expirations

Looking to November, a handful of high-profile lock-up expirations could drive secondary activity and price volatility. Notable outperformers Figma (+38.3% alpha to market) and Hinge Health (+40.1%) expire on November 7 and November 17, respectively.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.