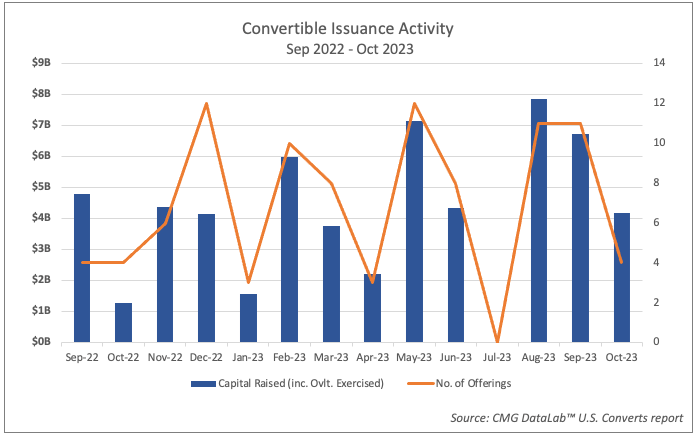

U.S. convertible offering activity in September and October raised $10.9Bn (inc. overalloment exercised) via 15 transactions tracked by CMG, a 79% increase from the $6.08Bn raised via 8 transactions the same period last year.

In the U.S., two offerings represented a third of capital raised. Rivian Automotive, Inc. and Western Digital Corp. were the largest convertible offerings overall for the months of September and October with principal amounts of $1.725Bn and $1.6Bn, respectively.

Technology, the most active sector, comprised nearly half (46%) of convertible offerings volume via 6 transactions totaling $4.98Bn in principal amount (inc. overallotment exercised). In the face of choppy market conditions, issuers continue to evaluate convertible bonds as vehicles for liquidity.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.