October laid the groundwork for a busy Q4, with $33.6B raised via 46 offerings with market capitalization over $250M in the U.S.—the largest monthly dollar volume since November 2021. This total consisted of $4.0B via 9 IPOs and $29.6B via 38 follow-on offerings, trading up 24.1% and 4.8% respectively on a dollar-weighted basis on Day 1. The month’s average file-to-offer discount was 9.3%, tied for the highest monthly average in the past two years.

The volume was bolstered by Boeing Co. (BA), which completed a historic marketed follow-on offering in late October, raising $18.5B. This was the largest follow-on since American International Group Inc. (AIG) priced a $20.7B marketed follow-on in September 2012. Boeing concurrently priced a $5.0B convertible bond, tied as the fourth-largest convertible on CMG record. Together, this marketed follow-on and convertible bond pairing marked the largest of its kind.

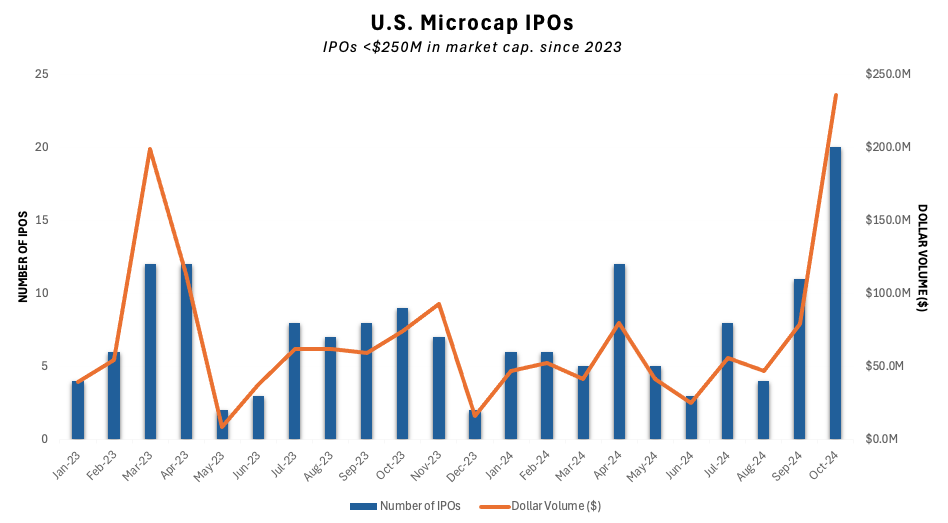

While October saw major contributions from large issuers, microcap offerings also set new watermarks. Excluding offerings with market caps over $250M, 29 smaller offerings collectively raised $427.7M, including 20 IPOs—the highest such volume on record, underscoring signs of a risk-on trade.

Additionally, SPAC IPOs made a resurgence, with 9 offerings raising $1.6B, marking the highest monthly count and dollar volume since Q1 2022.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.