Despite a shorter window due to election week and Thanksgiving Day, November delivered stellar performance. A total of 64 offerings raised $18.5B, with 61 follow-ons contributing $18.2B and 3 IPOs raising $303.8M. All 3 IPOs, along with 4 follow-ons, involved cornerstone investors. 2024 YTD has averaged 7 IPOs per month, outperforming both 2022 and 2023. With one month to spare, 2024 IPO dollar volume surpasses 2023 by 54.6%. Additionally, 6 SPACs raised $635.5M in capital, marking the sixth consecutive month with at least 5 SPACs and over $600M in volume.

Follow-ons led the charge in November, with 9 issuers conducting their first follow-on post IPO. Notably, companies like OneStream and Life360 returned to the market just 114 and 162 days after going public earlier this year. First follow-ons traded up 1.99% on a dollar-weighted basis at the open.

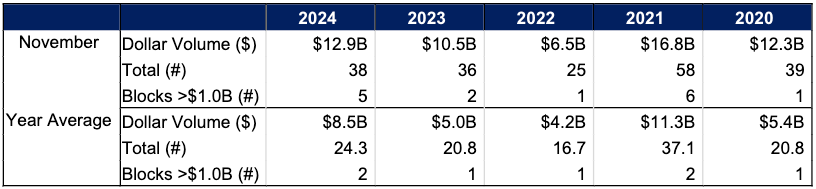

Blocks played a significant role, contributing 69.7% of the month’s volume. Unregistered blocks accounted for $6.9B, while registered blocks added $6.0B. November marked a milestone with 5 blocks exceeding $1.0B raises, a feat not seen since November 2021. Excluding 2021, yearly block volume for 2024 is the highest since 2016.

Historically, November has been a strong month for block volume, and 2024 was no exception. Both block count and dollar volume exceeded yearly averages dating back to 2015.

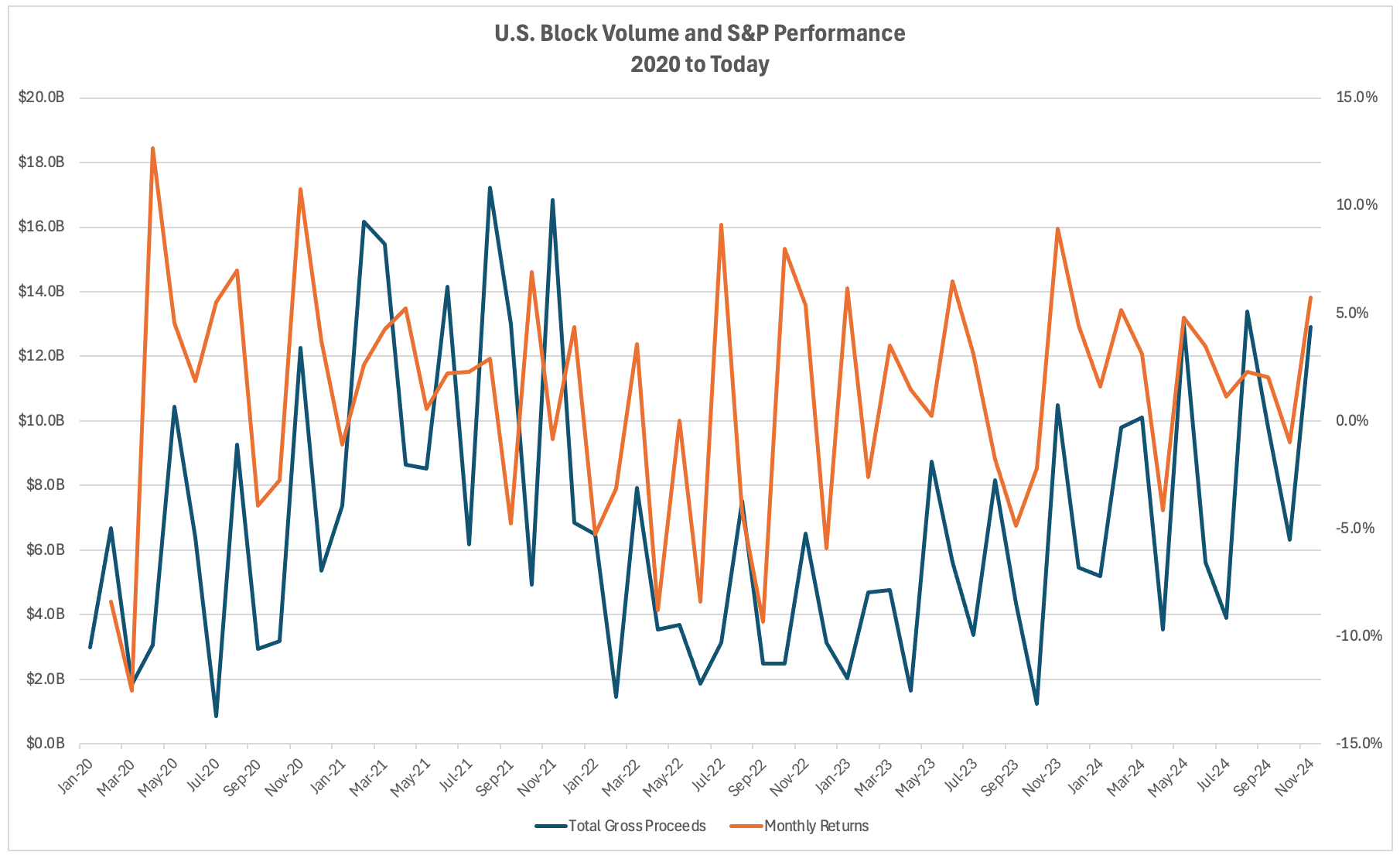

Analysis shows a correlation between higher market returns (S&P 500) and increased block activity in the preceding month and The S&P 500 hit new highs in November. Although December typically shows more muted activity, with strong momentum from November’s performance and robust trends in activity, the stage is set for an exciting close to 2024 and a promising backdrop for IPOs heading into Q1 2025.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.