It used to be a rule of thumb on Wall Street that January set the tone for the whole year, but don’t write off 2022 just yet. The IPO market cooled a bit this January due to market volatility, mainly driven by the anticipation of the Fed raising rates this year and ongoing supply chain constraints. The recent FOMC meeting met the consensus expectations that the Fed will likely begin raising rates in March while tapering is scheduled to conclude in mid-March.

We saw 51 deals (excluding SPACs) price in January, with a (6.9)% offer to current as of February 1, during one of the worst-performing months in the S&P 500 since March 2020. IPOs accounted for 9 of the deals with 42 Follow-Ons.

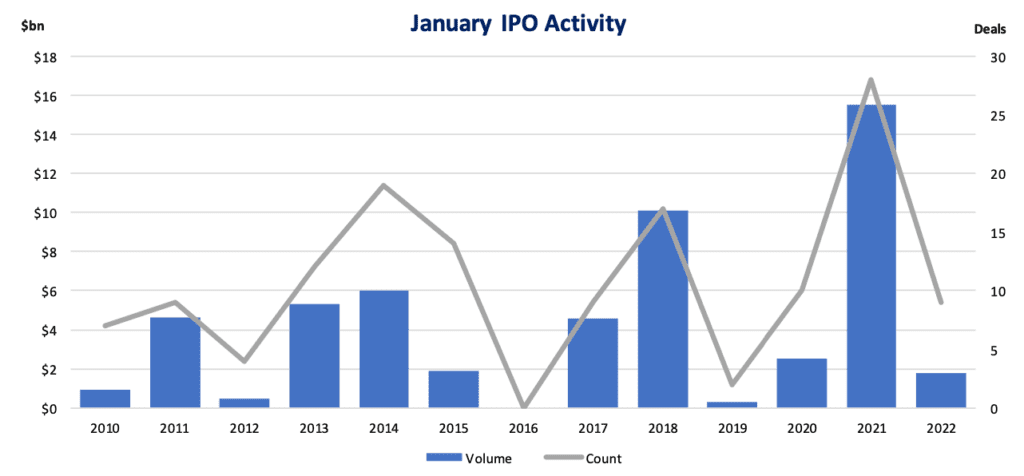

While January’s $1.8bn in IPO issuance was starkly lower than 2021’s first month of $15.5bn, IPOs that came to market this month traded on average 6.1% higher a week after pricing. The market saw 5 IPOs price with an offering size above $25M, with 4 of the 5 pricing within their initial range. All 4 are currently trading at an average of 20% above offer.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.