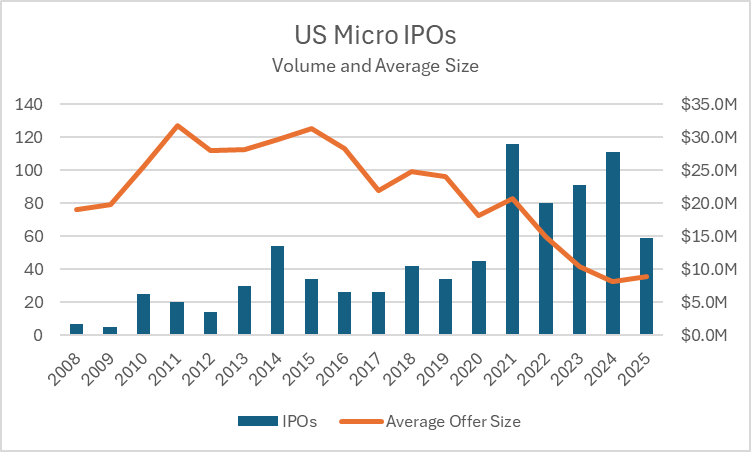

The U.S. equity capital markets have experienced a surge in microcap IPOs. From 2008 to 2020, the average was 28 micro-IPOs annually. However, since 2021, this average leapt to 90 per year, more than tripling the previous figure. Q4 of 2024 set a new quarterly record with 42 micro-IPOs, a 31.3% increase over the previous high, and Q1 2025 trended in the same direction with another 41 offerings.

Despite the increase in the number of micro-cap issuers going public, the average size of these IPOs has decreased significantly. From 2008 to 2020, the average size was $27.7M, dropping to $14.6M from 2021 onwards. Year-to-date, the average size is just $9.3M. This trend indicates a growing appetite to tap into the public market, but what’s driving it?

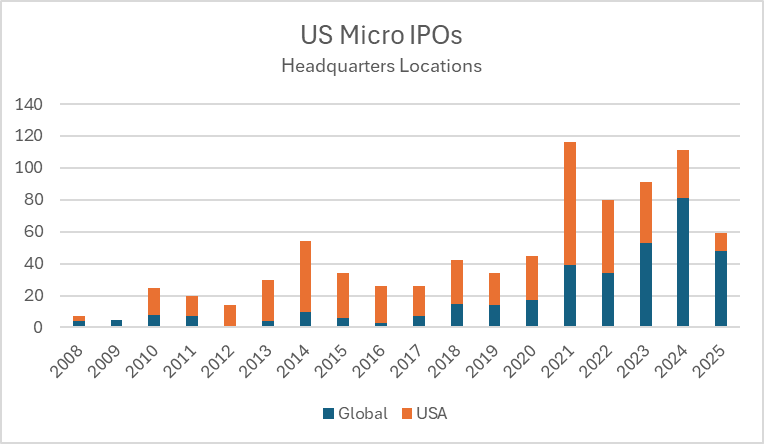

Since the start of 2023, 69.8% of micro-IPOs launched in the U.S. are headquartered abroad, highlighting the global appeal of U.S. markets. Foreign Private Issuers—especially from China, Hong Kong, and Southeast Asia—have increasingly tapped U.S. markets for micro-cap IPOs, driven by limited domestic options, favorable U.S. listing rules, and the global prestige of Nasdaq.

In July 2024, NYSE American raised its IPO threshold to a minimum of $10M in gross proceeds, pushing more issuers to list on Nasdaq. Since this change, 87.6% of U.S. micro-IPOs have been priced on Nasdaq, with only 16 priced on NYSE. While this influx has reshaped the small-cap landscape, it has also triggered volatility and prompted discussions around tighter oversight.

Contact [email protected] to request a demo.

This information provided is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. You should not act or refrain from acting on the basis of any of this information. Past performance is no guarantee of future results. CMG shall have no liability whatsoever for your use of this information.